How We Raised $2M in Pre-Seed and Seed Funding: A Deep Dive Into Our Pitch Decks

Learn how we secured $2M in pre-seed and seed funding and discover the secrets behind our successful pitch decks.

As founders, we know that raising capital can often feel like navigating a maze. The journey from idea to investment can be long and challenging, especially if you’re new to the process. That’s why we want to share our experience of raising a total of $2M in pre-seed and seed funding — and give you a behind-the-scenes look at the pitch decks that helped us get there.

In this post, we’ll go over the key components of a pitch deck that can capture investors’ attention, and show you both our oldest and most recent decks. Our goal is to provide actionable insights for fellow founders, so you can build a deck that not only gets seen but also gets funded.

We started with a simple concept and a small team, but over time, we learned what investors care about most — and what they don’t care about. The first version of our pitch deck was rough, but it got the job done. As we progressed through our fundraising journey, we refined it, sharpened the messaging, and aligned it with the priorities of investors at each stage. The result? $2M in funding.

To make this experience more tangible for you, we’re sharing both versions: the oldest deck that helped us close our pre-seed round, and the most recent deck that helped us secure our seed round.

But before we dive into the decks, let’s break down the essential components of any great pitch deck.

Key Components of a Winning Pitch Deck

1. Clear Problem Statement

The foundation of any great pitch deck is the problem you’re solving. Investors want to know that your startup is addressing a significant pain point or market gap. In our earliest deck, this section was simple and focused primarily on the frustration that our target audience faced. But by the time we raised our seed round, this slide was much more data-driven, supported by user research and early feedback.

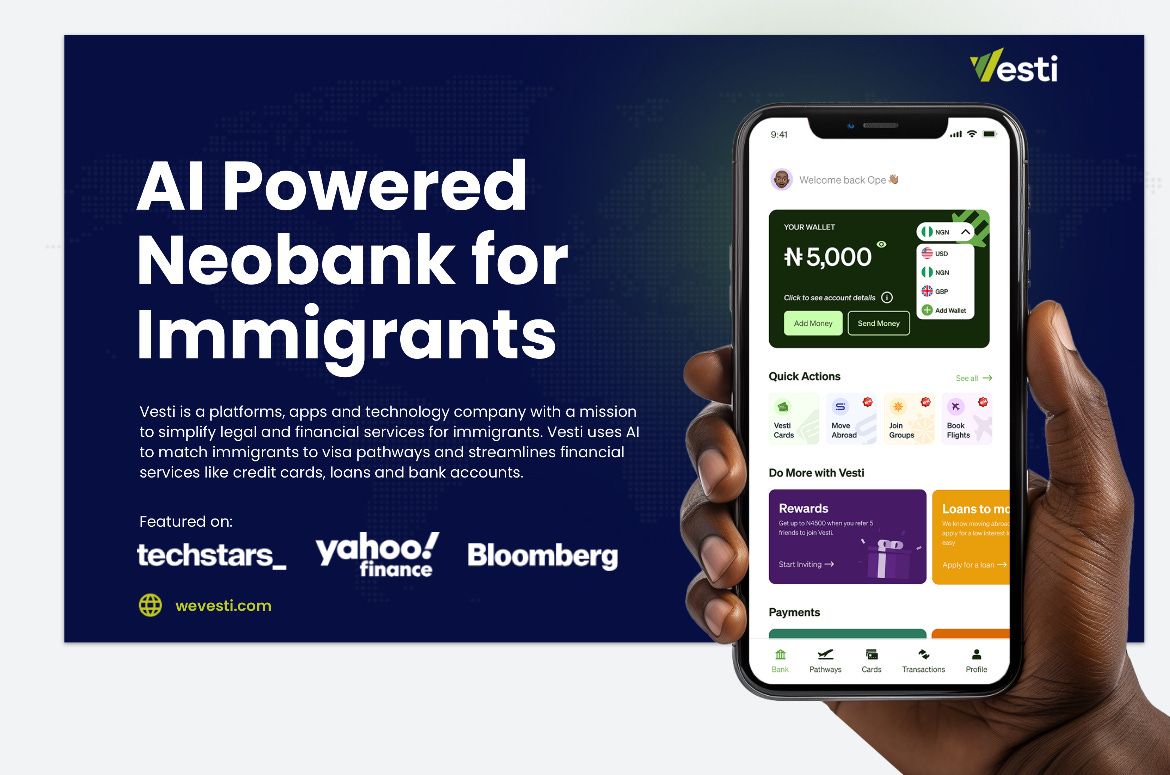

2. Your Solution (Product/Service)

After highlighting the problem, you need to show how your product or service solves it. This is where most founders get too bogged down in the technical details. While it’s important to explain the value of your product, keep it concise. In our pre-seed deck, we were still figuring out our product-market fit, so we kept this section more aspirational. By our seed round, however, we had clear customer testimonials and use cases that proved our solution worked.

3. Market Opportunity

Every investor wants to know the size of the market you’re targeting. It’s not enough to say, “The market is huge!” You need to demonstrate a sizable and growing opportunity. For our seed deck, we invested a lot more time in market research, and as a result, this section was backed by concrete data — from industry reports to customer surveys. Your deck should convey how big the potential upside is.

4. Traction

Investors want to know that your business is moving in the right direction. Traction can mean different things, depending on your stage. In our early deck, traction was about the number of users we had, or the partnerships we were securing. For the seed round, we showed revenue growth, key metrics like monthly active users, retention rates, and market share increases. Make sure to track and showcase the KPIs that matter most.

5. Business Model

This is where you explain how you plan to make money. Keep it straightforward, and avoid making it sound like an afterthought. Our pre-seed deck was more conceptual in terms of the business model, but by the seed stage, we were able to confidently show how we’d generate revenue, scale, and increase profitability.

6. Go-to-Market Strategy

You need a clear plan for how you’ll acquire customers and scale. We went from a general strategy in our pre-seed deck (focused on early adopters) to a more detailed, multi-channel plan in the seed deck (including paid ads, partnerships, and content marketing). Make sure investors see that you have a realistic path to customer acquisition.

7. Financial Projections

This is one of the trickier parts, especially in the early stages. Investors expect to see your financial model, even if it’s based on assumptions. Don’t just show revenue projections; show how you’ll manage expenses, how much funding you need, and how you’ll use the capital. Early on, our financials were a rough estimate, but by the time we raised the seed round, we had detailed projections that showed a clear path to profitability.

8. Team

Investors are betting on you and your team just as much as your idea. In our pre-seed deck, we focused more on our individual backgrounds and why we were passionate about the problem. By our seed stage, we included our growing team, with specific roles, expertise, and the unique contributions of each team member. Investors want to know that you have a talented team that can execute your vision.

9. The Ask

Make sure you’re clear on how much capital you’re raising and what you’ll use it for. Early on, our “ask” was simpler, focusing mainly on product development and initial marketing. As we got to the seed stage, we had a more detailed breakdown of how the funds would be allocated — including hiring key positions, scaling operations, and expanding to new markets.

10. Vision and Exit Strategy

Investors want to know that you have a long-term vision for the company. What’s your exit strategy? Are you planning for an acquisition, an IPO, or something else? By the time we raised our seed round, we had a clear vision of where we wanted to take the company and how we would get there.

Our Oldest Deck (Pre-Seed) vs. Most Recent Deck (Seed)

To give you a real-world example, we’re sharing both our oldest pitch deck (used for the pre-seed raise) and our most recent deck (used for our seed round). You’ll see how the messaging evolved and how we honed our pitch to better align with investor expectations at each stage.

You can find both decks in the download section below. Take a look, learn from our journey, and see how we’ve improved with each iteration.

Oldest Pitch Deck: https://docsend.com/view/azygcf8mxcgj453j

Most Recent Pitch: https://docsend.com/view/w7b7y9t8qmpqqzep

If You’re a Founder Looking for an O-1 or EB1 Visa Sponsorship

If you’re a fellow founder in the U.S. on a visa, or someone who is looking for sponsorship for an O-1 or EB1 visa, we want to help. Our experience navigating the visa process has been eye-opening, and if you’re an international founder in need of sponsorship, we might be able to support you as you build your company.

Interested in working with us? If you’d like to explore the possibility of a visa sponsorship swap or discuss how we can help your startup grow, sign up below, and let’s chat.

Email Talentvisa@wevesti.com and cc me olu@wevesti.com With subject Founder Visa (Startup name)

E.g “Founder Visa (Vamp AI)

Final Thoughts

Raising capital is hard, but it’s not impossible. By focusing on the key elements of your pitch deck and refining it over time, you can significantly improve your chances of success. Use the lessons we’ve shared and apply them to your own fundraising journey. We hope this post helps you navigate the maze of venture capital and secures the funding your startup needs to grow.

Feel free to reach out if you have any questions or need advice — we’re always happy to help fellow founders!