Introducing SafeLock by Vesti: Revolutionizing Savings

Secure your financial future abroad with Vesti's SafeLock - simplify your finances and focus on your exciting move!

Are you looking to save for your migration journey or build your financial future with ease and flexibility?

Introducing, SafeLock by Vesti – your ultimate savings companion developed to make saving simpler and more rewarding than ever before. With a host of innovative features, SafeLock empowers you to create, track, and achieve your savings goals effortlessly. Let's find out what makes SafeLock the go-to solution for migration savings.

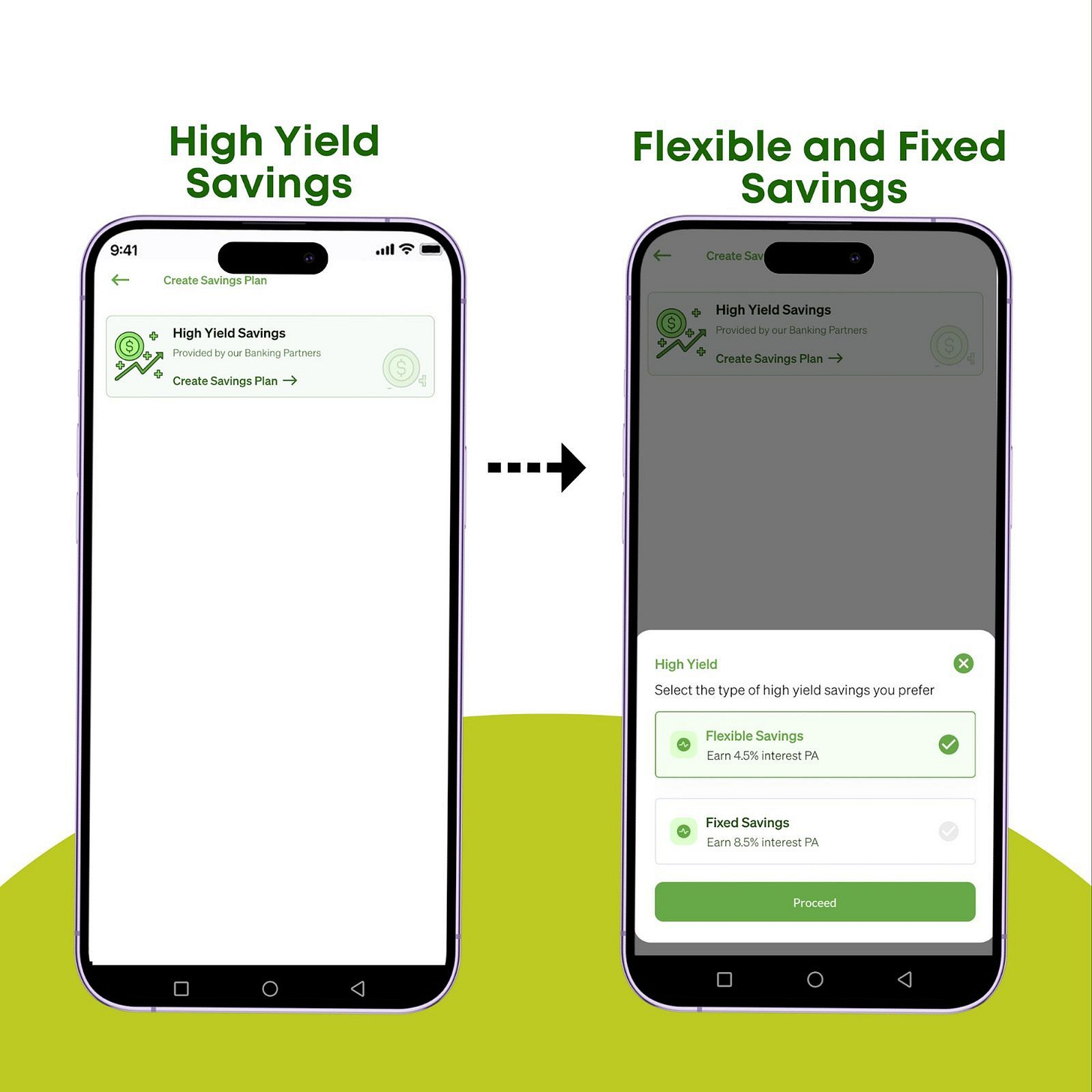

Create New Savings Plan : This feature allows users to create simple savings and start saving immediately. The “Create New Savings Plan feature” gives users access to the high yield savings plan from which users can choose from two available savings plans options:

Flexible Savings Plan

Fixed Savings Plan

Savings Target: SafeLock by Vesti was developed with the understanding that users have varying savings goals. Therefore, with the “Savings Target Feature” users are enabled to create a savings target they can commit to; by personally setting:

Savings Name: That addresses the users reason for savings.

Targeted Amount

Savings Frequency: That is how often the user would want to be saving; this could be daily, weekly or monthly.

Savings Maturity: Users that opt for the flexible Savings Plan; with this feature can set the duration of their savings, while users opting for the fixed savings plan would be able to choose between savings duration of 6 months or 12 months.

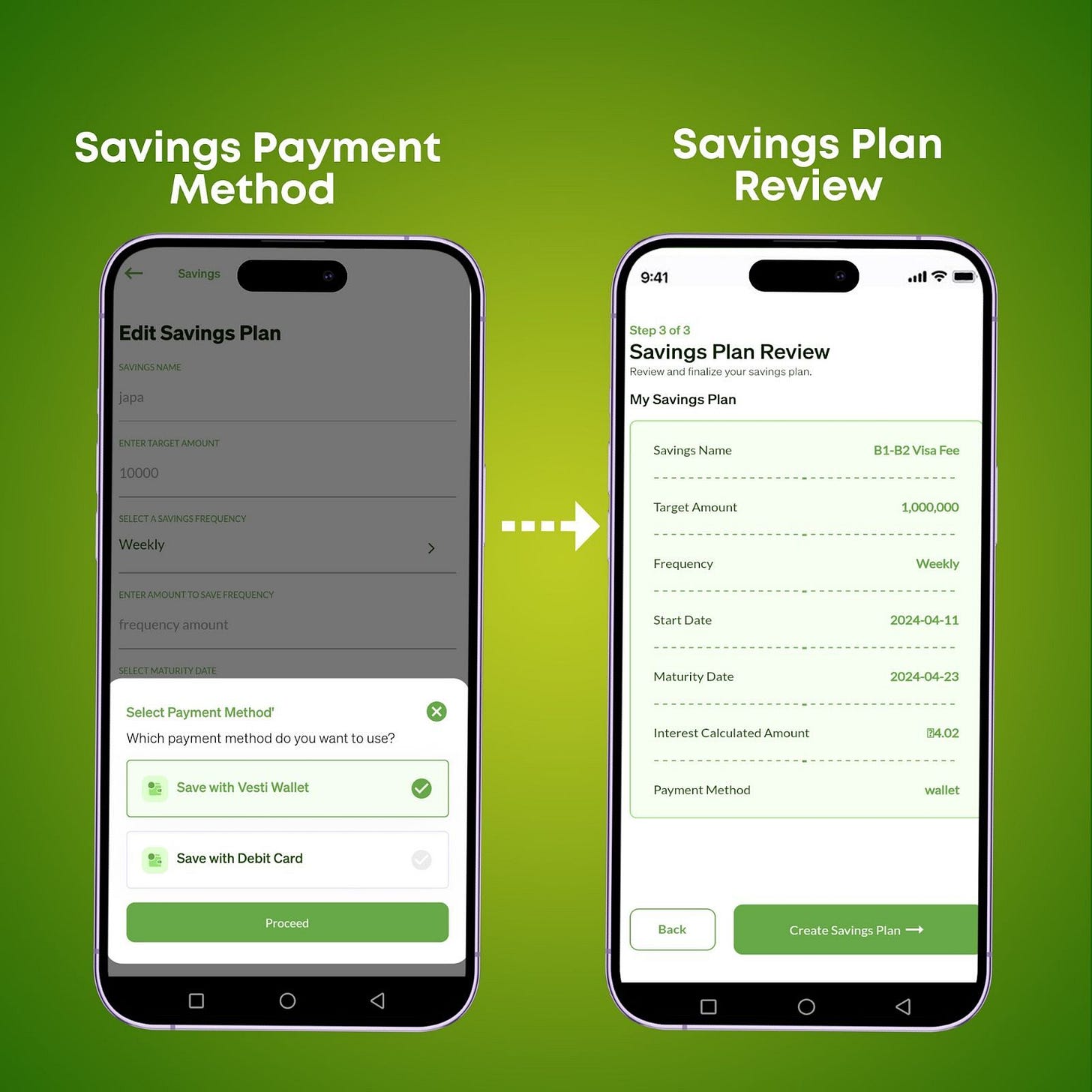

Savings Payment Method

SafeLock offers convenient “Savings Payment Methods” to suit users preferences. Users can choose to either :

Save with Vesti Wallet or

Save with Debit Card

Whether users prefer the seamless integration of their Vesti Wallet or their debit card, saving has never been more accessible. Simply input your card details to get started.

Savings Plan Review

This feature allows users to get a summarized overview of selected savings plan, savings plan name, target amount, savings currency, savings frequency and more before finalizing the creation of a new savings plan.

Other Important Features includes:

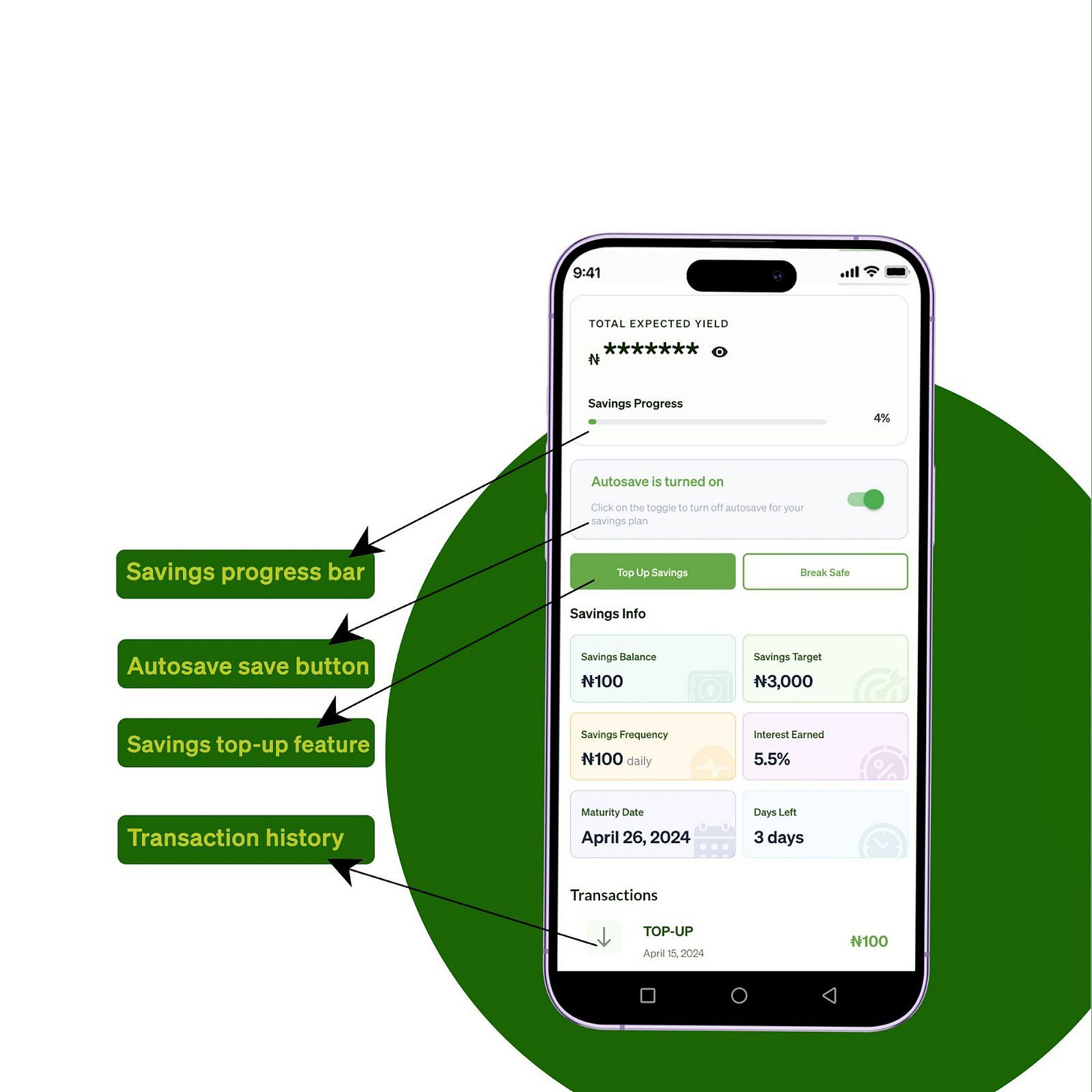

Total Savings: With this feature users can track the cumulative value of all their savings efforts.

Total Expected Yield: This feature keeps users informed about the potential returns on their savings.

View Savings Plan: Access detailed insights into each savings plan you've created. Also, with the “View Savings Plan” users can gain insights into savings information such as their savings balance, target amount, interest earned, and more.

Savings Progress Bar: This feature enables users to monitor their progress towards their savings goals at a glance.

Top Up Savings: Users can add money to their savings effortlessly, with the option for auto-save or manual top-right up functionality.

Break Safe:It is imperative to note that once the savings duration is set, users would only be able to access saved funds at the expiration date, which is the same as the set end date for the savings plan except the user “Break Safe”. Users that choose to “Break Safe” would forfeit the interest earned on their savings.

(P.S. The “Break Safe” functionality is only available for flexible savings plan)

Edit Savings Plan: This feature enabled users to edit only their savings frequency, and payment method

Transaction Feature: With this feature users can keep track of all transactions related to your savings plans, including top-ups and withdrawals.

Ready to embark on a new savings journey? With SafeLock, you can create new savings plans with ease, ensuring that every financial goal is within reach.

We would like to hear from you:

Please send your feedback on SafeLock by Vesti Product Feature by replying to or contacting us via help@wevesti.com

We welcome any suggestions or requests for new features you would like to see on Vesti, as well as any ideas for improving existing features. Your input is valuable to us!