If you've ever used a financial platform, you’ve probably heard about KYC, or Know Your Customer. It’s a process designed to keep financial transactions secure and prevent fraud. While it may sound complex, it’s simply a way for platforms to verify who you are before giving you full access to their services.

Vesti’s KYC comes in three levels, and each level determines how much you can withdraw. The more information you provide, the more access you get. Let’s break it down in an easy-to-understand way.

Here’s how each KYC level works—and what it unlocks for you

Level 1: Basic Verification

Requirements: Minimal information such as name, email, phone number and Identification (ID) Number. The identification document admissible varies on accepted form of identification of the user's country, for example Nigerian can give the ID Number as on their NIN, International Passport or Voters.

Withdrawal Limit: Lowest withdrawal limit, typically restricting large transactions.Thus, users on level 1 have an instant withdrawal limit of N50,000 on their naira wallet

Purpose: Ensures basic user identification while allowing entry-level access to services.

Level 2: Intermediate Verification

Requirements: Additional information such as government-issued ID upload, an uploaded clear picture of the user holding the ID card and address proof.

Withdrawal Limit: Moderate withdrawal cap. an instant withdrawal limit of N100, 000 on naira wallet, allowing users to transact more freely.

Purpose: Enhances user authentication and security, minimizing risks associated with fraud.

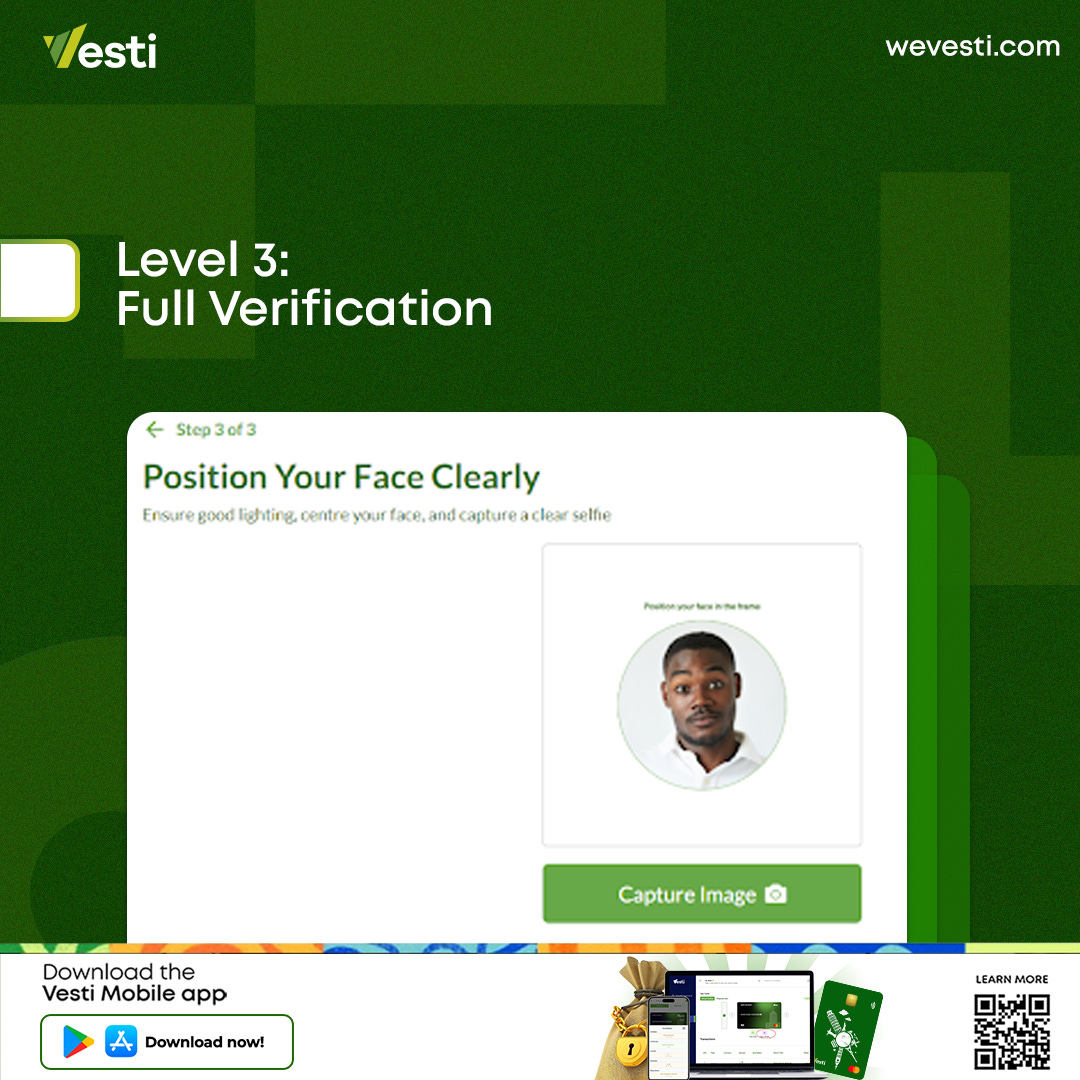

Level 3: Full Verification

Requirements: Advanced verification such as biometric data- face recognition verification

Withdrawal Limit: access to the highest withdrawal limit, available on the Vesti’s App, subject to policies and regulatory standards

Purpose: Ensures full compliance with regulatory standards and provides maximum security.

How Withdrawal Limits Link to KYC Levels

Your withdrawal cap grows as you move up the KYC ladder. Level 1 gives you small daily limits, while Level 3 users who’ve shared extensive verification enjoy the highest limits. These tiers help us comply with anti-money laundering rules while keeping your funds safe.

Benefits of Upgrading Your KYC Level

Bigger Transactions

Unlock higher withdrawal and transfer limits.Faster Onboarding

Breeze through checks and start transacting sooner.Better Security

Advanced checks mean fewer hiccups and peace of mind.Priority Support

Level 3 users get faster response times from our team.

Next Steps: How to Level Up

Open your Vesti App and go to Profile

Click on your KYC level right on your dashboard > Verification

Select Location (Country)

Select the next level you want to complete

Upload required documents and follow the on-screen prompts

Wait as our system reviews your info

Celebrate when you see your new limits in Wallet

KYC is the backbone of a secure financial ecosystem. To increase your limits, simply progress through the levels by uploading the required documents. Understanding these tiers means you can plan your transactions with confidence and stay fully compliant with both Vesti’s policies and regulatory requirements.

Need Help?

Our support squad is on standby

Email: help@wevesti.com

WhatsApp: +234 801 234 5678

Got suggestions? We’re all ears. Shoot us a message. Your feedback shapes what’s next.